IGS Accounting, Controlling & Consolidation

Integrated IGS accounting consists of the applications IGSMT®F Financial Accounting, IGSMT®A Asset Management and IGSMT®C Controlling. The modern look and feel impresses with intuitive navigation and innovative visual processing of the reporting information, which is available in real time.

The information quality is increased by the drill-down function on the digital document in the IGSMT®D Document Management.

Various language and country versions are available due to the international orientation.

The following features distinguish IGS Finance:

- Modern front end – IGS Graphical Workspace (autostarts, menu models, navigation tree, cross-client tabs)

- Business Intelligence (BI) and Dashboard Models (management reporting)

- Group accounting – Consolidation – Group Accounting

- Integration of document and workflow management

- Annual report generator and Excel connector (graphic models)

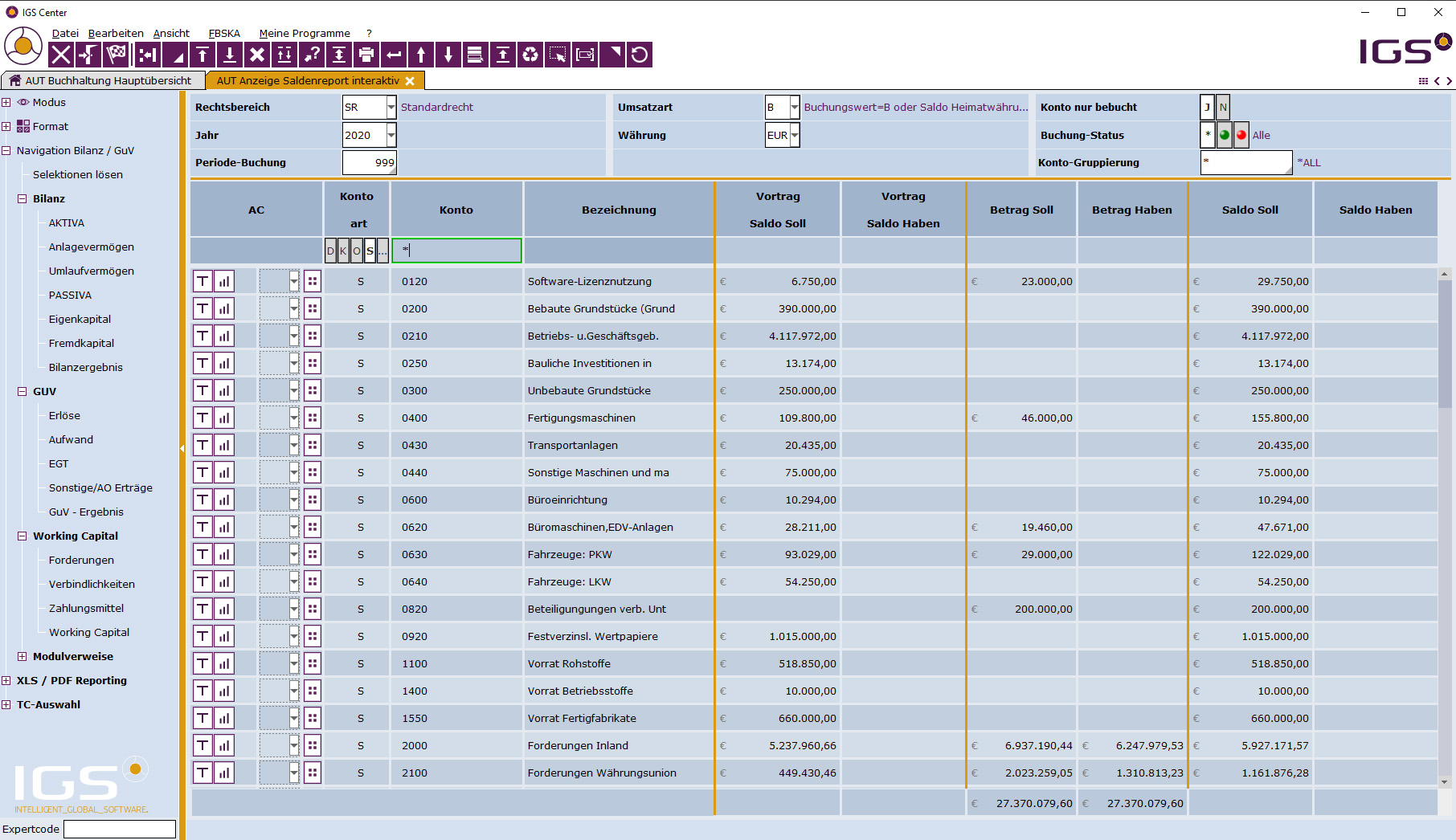

IGSMT®F Financial Accounting

IGS financial accounting relies on maximum support in operational activities via book entry managers (e.g. account statements), direct interaction with the incoming invoice workflow and efficient design of operational processes (e.g. dunning, UID check). Particular attention is paid to the information content and the information quality, so that meaningful real-time analyses can be navigated ad hoc.

The following features distinguish IGS Financial Accounting:

- Law neutral real-time book entry system (HGB, STG, US-GAAP, IFRS)

- Multi-client capability – redundancy-free data models (property, person, object accounts and controls)

- Book entry manager (account statements, fuel and telephone billing, notice import)

- Drill-down and roll-up functions to digital document or contract/notice

- Real-time balance sheet/P&L and reports (debtors-creditors)

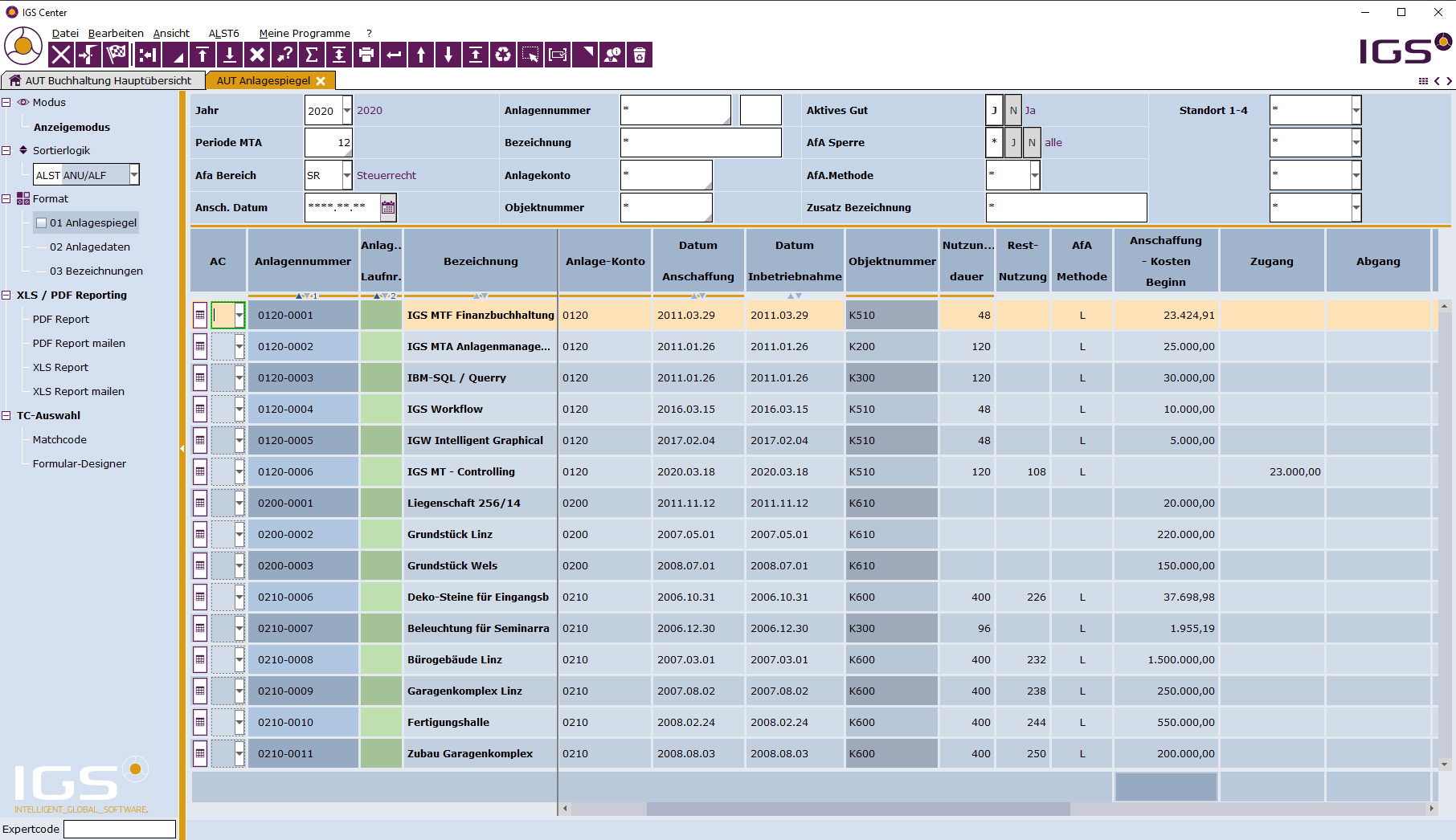

IGSMT®A Asset Management

The possibilities within the scope of IGS asset management go far beyond the classic asset accounting functions. They aim, among other things, to precisely control investments (replacement and expansion investments) and to plan (forecast, depreciation, financial requirements) as well as to create well-founded forecasts for development (forecast) – based on controlling. The range of functions extends to an integrated workflow, which can be used to process investment applications against the budget.

The following features distinguish IGS Asset Management:

- Customisable (group) investment statements in different legal areas

- Depreciation forecast, differentiated according to asset groups/balance sheet structure/cost centres

- Integration with a high level of automation in relation to document entry for fixed assets

- Calculation of depreciation, automated in real-time

- Generation of book entry/document for cost accounting and financial accounting

- Indicator reports (investment coverage, asset utilisation)

IGSMT®C Controlling

IGSMT®C Controlling is a versatile planning, control and decision-making instrument that uses innovative display forms or elements (e.g. integrated graphic models; traffic light, sort and select functions) to focus on the information relevant to decision-making. The controlling tool can be precisely and easily parameterized to the company-specific requirements, whereby the users themselves can also make definitions and simulate various scenarios (e.g. plan versions).

The following features distinguish IGS Controlling:

- Accounts receivable, accounts payable, personnel and receivable controlling

- Cost management – all cost accounting systems

- Actual, plan and target value analyses with integrated traffic light functions, CAGR

- Comprehensive key figure reports, multi-year comparisons

- Finance and liquidity plan (cash flows)

- Integrated planning system for all areas (personnel, cost and revenue types)

IGSMT®C Balance Sheet Management

An integral part of IGS financial accounting is IGS balance sheet management, which can be called up directly via the drill-across function and also enables drill-down to the original document. IGS Balance Sheet Management is a modern reporting system that not only embeds the accounting records in the defined balance sheet and income statement schemes, generating meaningful reports from them, but also, a useful analytical tool. Multi-year comparisons, traffic light functions, rankings and many other interpretation aids sharpen the view.

The following report models, among others, are available via company-specific dashboards:

| Balance sheet | Track record / P&L |

|---|---|

| Structural balance | P&L Structure |

| Trend balance 5 years | Trend income statement 5 years / ø-growth |

| Trend balance 12 months | Trend P&L 12 months |

| Trend balance 4 quarters | Trend P&L 4 quarters |

| Flow-of-funds statement |

|---|

| Flow-of-funds statement- Trend |

| Balance sheet analysis | Balance sheet analysis and plan values budget |

|---|---|

| ROI | Cash flow 1, 2, 3 / capital flow |

| Indicator system | P&L Structure |

| Budgeted balance sheet | Target P&L |

| Accounts Receivable Reporting | Accounts Payable Reporting |

|---|---|

| Sales analysis | Sales analysis |

| Balance analysis | Balance analysis |

IGSMT®C Consolidation

The economic units of a group and their intra-group transactions, as well as different currencies, financial years and legal systems, involve considerable consolidation requirements. The innovative methodical approach behind IGS consolidation takes the complexity out of these consolidation processes and definitively adds an interactive, meaningful and high-quality facet to group reporting:

- Ad hoc capital, debt, interim results, expenses and income consolidation

- User-definable legal areas (SR, UR / HR, IAS / IFRS, US GAAP, IKR in the standard)

- Automated group accounting (intercompany)

- Fast close models

- Group accounting – as a whole and according to consolidation groups

- Group indicator systems